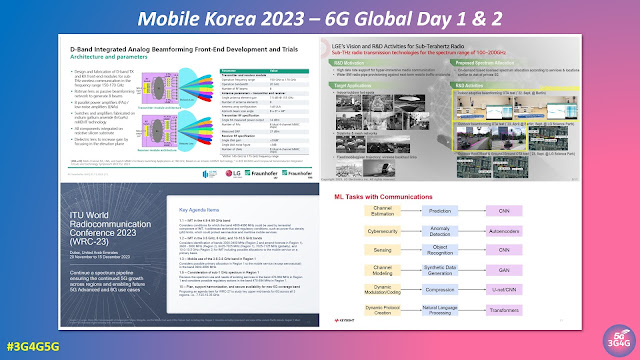

5G Forum, South Korea organises Mobile Korea conference every year. Mobile Korea 2023 had two conferences within it, '6G Global', looking at 'Beyond Connectivity and New Possibilities', and '5G Vertical Summit', looking at 'Leading to Sustainable Society with 5G'.

Selected videos from Mobile Korea 2023 5G Vertical Summit are available here: https://t.co/zozmQ43s0v #Free5Gtraining #3G4G5G #MobileKorea #5GSummit #UAM #KUAM #ITS #AutonomousDriving #V2X #CV2X #Sidelink #NTN #PrivateNetworks #Healthcare #SmartCity #APIs pic.twitter.com/7Xrv8V1L4s

— Free 5G Training (@5Gtraining) December 4, 2023

I often complain about how organisations working in 6G often lack social networks skills, in this case, even the website is not very user friendly and doesn't contain a lot of details. Full marks for uploading the videos on YouTube though.

Anyway, here are the videos and presentations that were shared from the summit:

- Opening + Keynote Session - Moderator : LEE, HyeonWoo, DanKook University

- Standardization and Technical Trend for 6G, SungHyun CHOI, Samsung Research (video, presentation)

- Session 1 : 6G Global Trend - Moderator : JaeHoon CHUNG, LG Electronics Inc.

- Thoughts on standardization and Industry priorities to ensure timely market readiness for 6G, Sari NIELSEN, Nokia (video, presentation)

- On the convergence route for 6G, Wen TONG, Huawei (video, presentation)

- The Path from 5G to 6G: Vision and Technology, Edward G. TIEDMANN, Qualcomm Technologies (video, presentation)

- Shaping 6G – Technology and Services, Bo HAGERMAN, Ericsson (video, presentation)

- Government Session

- Keynote : Korea's 6G R&D Promotion Strategy, KyeongRae CHO, Ministry of Science and ICT (video, presentation)

- Session 2 : 6G Global Collaboration - Moderator : Juho LEE, Samsung Electronics

- 6G R&D and promotion in Japan, Kotaro KUWAZU, B5GPC (video, presentation)

- Technology evolution toward beyond 5G and 6G, Charlie ZHANG, Samsung Research (video, presentation)

- AI-Native RAN and Air Interface : Promises and Challenges, Balaji Raghothaman, Keysight (video, presentation)

- Enabling 6G Research through Rapid Prototyping and Test LEE, SeYong, (NI) (video, presentation)

- Global Collaborative R&D Activities for Advanced Radio Technologies, JaeHoon CHUNG, LG Electronics (video, presentation)

- International research collaboration – key to a sustainable 6G road, Thomas HAUSTEIN, Fraunhofer Heinrich Hertz Institute (video, presentation)

- 6G as Cellular Network 2.0: A Networked Computing Perspective, KyungHan LEE, Seoul National University (video, presentation)

- Towards a Sustainable 6G, Marcos KATZ, University of Oulu (video, presentation)

- Pannel Discussion : Roles of Public Domain in 6G R&D - Moderator : HyeonWoo LEE, DanKook University

- 6G R&D Direction and Introduction of IITP, SungHo CHOI, IITP (video, presentation)

- NICT's role for Beyond 5G R&D, Iwao HOSAKO, NICT (video, presentation)

- 6G Smart Networks and Services JU: R&D for 6G in Europe, Alexandros KALOXYLOS, 6GIA (video, presentation)

- Taiwan 6G Vision and R&D Activities SHIEH, Shin-Lin, ITRI (video, presentation)

- Session 3 : 6G Global Mega Project - Moderator: YoungJo KO, ETRI

- Sub-THz band wireless transmission and access technology for 6G Tbps data rate, JuYong LEE, KAIST (video, presentation)

- The post Shannon Era: Towards Semantic, Goal-Oriented and Reconfigurable Intelligent Environments aided 6G communications, Emilio CALVANESE STRINATI, CEA Leti (video, presentation)

- Demonstration of 1.4 Tbits wireless transmission using OAM multiplexing technology in the sub-THz band, DooHwan LEE, NTT Corporation (video, presentation)

- Latest 6G research progress in China, Zhiqin WANG, CAICT (video, presentation)

If there are no links in video/presentation than it hasn't been shared.

Related Posts:

- Free 6G Training: RF Sampo Seminar on 'Future mobile radio frequency technologies and solutions'

- Free 6G Training: CEPT Workshop on 6G Mobile Communications

- The 3G4G Blog: Presentations from ETSI Security Conference 2023

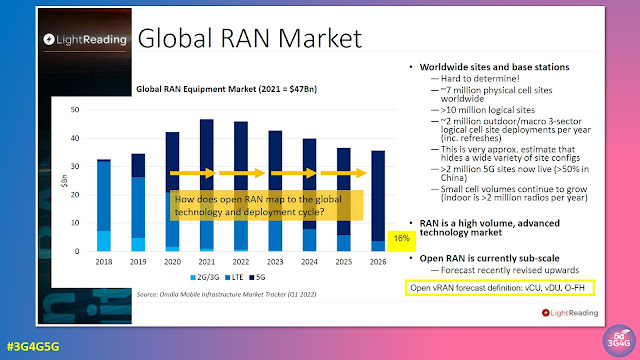

- The 3G4G Blog: Presentations from 2nd IEEE Open RAN Summit

- The 3G4G Blog: 3GPP TSG RAN and TSG SA Release-19 Workshop Summary