I wrote a blog post on this topic nearly three years back on the Operator Watch Blog here. That post is very handy as every few months someone or other asks me about this number. Here is a slightly updated number, though I am not confident on its accuracy.

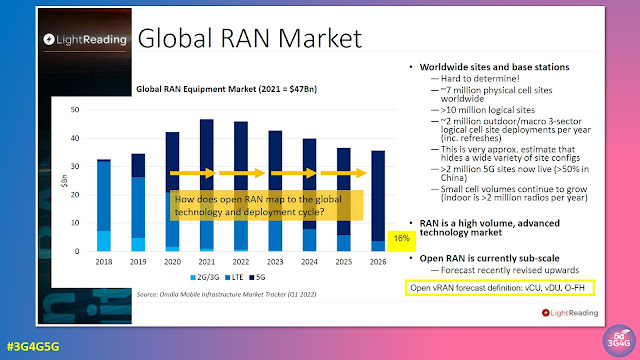

Gabriel Brown, analyst at Heavy Reading shares this chart above in the annual online Open RAN Digital Symposium. Based on the chart above, there are 7 million physical sites and 10 million logical sites. As there are many sites hosting infrastructure from multiple operators, the number of logical sites are more than the number of physical sites.

Again, most of the sites have distributed RAN (D-RAN) so there may be one or more base stations (baseband unit or BBU) and each base station can serve one or more radios. See links at the bottom for tutorials on these topics.

Per MIIT, new China 5G BTS shipments to drop by a third in 2023 relative to 2022 shipments. https://t.co/6iCMCh0ht6

— Stefan Pongratz (@StefanPongratz) March 9, 2023

China Tower had nearly 2.1 million telecom towers installed with 3.36m tower tenants at end of 2022. An MIIT minister said that China's operators will deploy 600k 5G base stations in 2023, taking total to 2.9m.

Astonishing scale of investment and execution in #China for #5G, creating a pervasive connectivity fabric that is driving massive digital transformation. 1.4 million base stations for 5G alone!!! For perspective, that nearly 3x India's total base station count...@mandalainsights https://t.co/9djZiiy67t

— Shiv Putcha (@shivputcha) January 21, 2022

The number of 5G radios in India just crossed 100,000 according to latest data released by the Department of Telecommunications. A base station generally manages multiple radios so not sure how many base stations would be there for 5G and even for older Gs.

In South Korea, according to the Ministry of Science and ICT and the mobile communication industry, as of December 2021, had 460,000 5G wireless stations of which, base stations accounted for 94% of the total, or 430,000 units, while repeaters only accounted for 30,000 units, or 6%.

Light Reading reported in September 2022 that there are nearly 419,000 cell sites across the US, according to the newest figures from CTIA.

China and USA are roughly the same size so you can see how China is ensuring their mobile networks provide the best QoE. It should also be noted that the population of China is over four times that of the USA. On the other hand, India and China have the same population but India is one third the size of China roughly.

Related Posts:

- Operator Watch Blog: How many 5G Cell Towers & Base Stations Worldwide?

- The 3G4G Blog: Different Types of RAN Architectures - Distributed, Centralized & Cloud

- The 3G4G Blog: Open RAN Terminology and Players