eCall (an abbreviation of "emergency call") is an initiative by the European Union, intended to bring rapid assistance to motorists involved in a collision anywhere within the European Union. The aim is for all new cars to incorporate a system that automatically contacts the emergency services in the event of a serious accident, sending location and sensor information. eCall was made mandatory in all new cars sold within the European Union as of April 2018.

In UK, the National Highways have a fantastic summary of the eCall feature here. The following video explains how this feature works:

Last year, ETSI hosted the Next Generation (NG) eCall webinar and Plugtests. The presentations from the event are available here. The presentations from GSMA, Qualcomm and Iskratel have a fantastic summary of many of the issues and challenges with eCall and transitioning to NG eCall.

From the Qualcomm presentation:

The eCall standardisation began in 2004 when 2G networks were prevalent and 3G was being deployed. The chosen solution was in-band modem and Circuit Switched (CS) 112 call. The in-band modem was optimised for GSM (2G) and UMTS (3G) as the standard completed in 2008.

eCall for 4G (NG eCall) standardisation was started in 2013 and completed in 2017. As there is no CS domain in 4G/5G, IMS emergency calling will replace circuit switched emergency call. Next generation (NG) eCall provides an extension to IMS emergency calls and support for 5G (NR) has since been added.

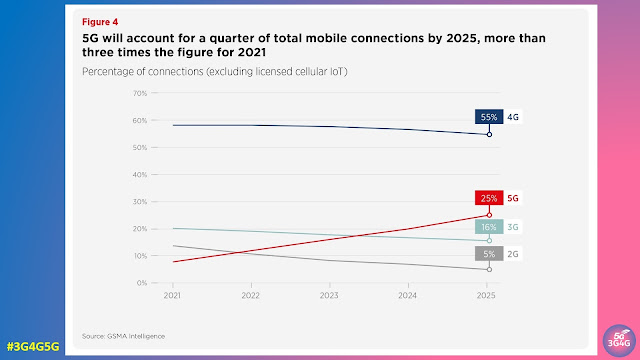

The picture above from GSMA presentation highlights the magnitude of the problem if NG eCall deployment is delayed. GSMA is keen for the mobile operators to switch off their 2G/3G networks and only keep 4G/5G. There are problems with this approach as many users and services may be left without connectivity. Fortunately the European operators and countries are leaving at least one previous generation of technology operational for the foreseeable future.

GSMA's presentation recommends the following:

- New technology neutral eCall Regulation (type approval and related acts) to be amended, adopted by European Commission and enter into force by end 2022 the latest.

- OEMs to start installing NG eCall /remotely programable/exchangeable modules by end 2022; by end 2024 all new vehicles sold in the market should be NG eCall only

- New vehicle categories to start with NG eCall only by 2024

- MNOs have initiated to phase out 2G/3G between 2020 and 2025 , whereas the optimal transition path of their choice beyond this date will depend on market and technology specifics, and may require alignment with NRAs.

- By 2022 , the industry will develop solutions for the transition period that need to be implemented country by country, which will also assess the amount of needed public funding to be economically feasible.

- Retrofitting to be acknowledged, completed and formalised as a process by end 2024; standards should already be available in 2022.

- Aftermarket eCall solution to be completed (including testing) and formalised by end 2024; standards should already be available in 2022.

- The European Commission to make available public funding to support OEMs and alternative solutions to legacy networks starting from 2022 , under the RRF/ recovery package (or other relevant instruments)

- Legacy networks availability until 2030 at the latest. By then deployment of all alternative solutions simultaneously would have ensured that the remaining legacy fleet will continue to have access to emergency services through NG eCall.

EENA, the European Emergency Number Association, is a non-governmental organisation whose mission is to contribute to improving people’s safety & security. One of the sessions at the EENA 2021 Conference was on eCall. The video from that is embedded below and all information including agenda and presentations are available here.

Related Posts:

- The 3G4G Blog: When will 2G & 3G be switched off now that 5G is here?

- The 3G4G Blog: GSMA Releases Mobile Economy Report 2022

- The 3G4G Blog: Are there 50 Billion IoT Devices yet?

- The 3G4G Blog: Study of Use cases and Communications Involving IoT devices in Emergency Solutions